Real estate, whether residential, commercial, industrial, or agricultural, is highly sought after in Pakistan. However, due to a lack of regulations, the sector is often in the limelight because of the number of related frauds being committed. It is therefore necessary that those who either own property or are looking to purchase one know at least the basics of property buying and selling laws in Pakistan.

Graana.com, Pakistan’s smartest property portal, takes a look at the laws that govern the sale and purchase of property in Pakistan. Furthermore, we answer some of the frequently asked questions in this regard.

Laws Governing Property Buying and Selling in Pakistan

Given below is a brief description of laws governing the sale and purchase of land in Pakistan. Get to know rental laws in Sindh.

Registration Act 1908

The Registration Act of 1908 was enacted to ensure that each real estate property was formally registered. It contains all the information necessary for property registration and is divided into fifteen sections. The act specifies the procedures and the locations where properties can be listed.

It also specifies the time and location of the document presentation. In summary, the Registration Act of 1908 is a comprehensive statute that provides clear guidance on all aspects of real property registration in Pakistan.

Transfer of Property Act 1882

The Transfer of Property Act of 1882 lays out in detail how Pakistan’s property should be transferred. It has a significant impact on property purchases and sales.

There are occasions when people will transfer land to another individual even if they are not legally permitted to do so, causing significant difficulty for the purchaser.

The Transfer of Property Act of 1882 goes into great detail about who is eligible to transfer property, how to transfer property, how to transfer property verbally, and which types of properties can be transferred.

Stamp Act 1899

The Stamp Act of 1899 directly impacts the government’s revenue because it specifies the various stamps required in the purchase and sale of Pakistan estate.

The act requires purchasers and sellers to pay a fee to the government in lieu of stamp papers, which are used to create legal agreements for the purchase and sale of the property in Pakistan.

Although stamp pricing may fluctuate owing to inflation and government regulations, the general Stamp Act 1899 urges participants of the Pakistan real estate market to use stamps to legitimize their purchases and sales officially.

Land Revenue Act 1967

The Land Revenue Act of 1967 lays out the whole hierarchy of Pakistan’s land and revenue department. It goes over the powers and jurisdictions assigned to the land and revenue department offices.

The Land Revenue Act also specifies how to land revenue should be collected. It also covers some of the most important topics, such as surveying, boundary delineation, partitions, and arbitrations.

FAQs on Property Buying and Selling

Below are some of the most frequently asked questions regarding buying and selling property in Pakistan.

Which document creates title in immovable property?

Register Sales Deed, also known as a Registry or Baye-Nama, creates the title for immovable property.

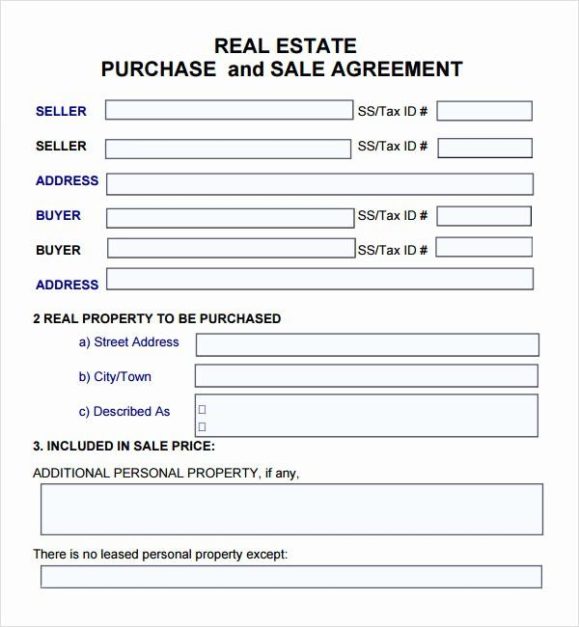

What is a sales deed?

Conveyance Sale or Sales Deed is a legal document that transfers ownership of property from the seller to the buyer. The act of transferring property ownership from a seller to a buyer is known as conveyance.

The deed document will assist you in determining whether the property you are purchasing is owned by any development corporation, society, or builder in the area.

Where can I obtain the title deed for my property?

You can get your paperwork or title deed documents from the office or department that conferred or transferred the property’s title.

What safety precautions should I take before buying or selling a property in Pakistan?

Before purchasing a property in Pakistan, it is necessary to do a comprehensive investigation of the seller’s title, along with any former owners’ titles.

The original title document (in the seller’s name) and other essential documents such as a mutation certificate, new copy of the fard, aks shajra, and no-objection or non-encumbrance certificate (as the case may be), must be obtained.

If the vendor is acting as the owner’s attorney in selling the property, the power of attorney must be properly registered with the appropriate sub-registrar. A holder of a forged and fabricated power of attorney is unable to transfer a legitimate title to a third party.

What documents should be inspected before buying a property?

Before buying property from a corporation, check with the Securities and Exchange Commission of Pakistan’s Registrar of Companies to ensure that the property is not mortgaged or being used as collateral against a loan; otherwise, it will not be regarded as a freehold property.

In addition, verify the memorandum of association to see who is authorised to sell the real estate on behalf of the firm; if a resolution is required, it must be passed and certified. Inspect the selling company’s original title paperwork as well.

What is a power of attorney?

A power of attorney is the authority granted by the principal to an agent to perform certain acts and deeds on his or her behalf. A power of attorney can also be issued to another individual to appear before any court, tribunal, or authority, to acquire, sell, or maintain the real estate, among other things.

When power is granted for a number of acts in a number of transactions, it is referred to as General Power of Attorney, and when power is granted for a single act in a single transaction, it is referred to as Special Power of Attorney. It is necessary to register a general power of attorney.

What documents should be inspected before buying an under-construction apartment?

Check the building’s approved plan, including the number of levels, and make sure the floor of your respective apartment is approved. Also, verify if the level on which the contractor is working is his or if he has a lease with a landlord (check the land ownership title if this is the case).

Look at the local building bylaws to see if there are any violations of front setbacks, side setbacks, height, or other requirements. Check the specifications in the deed of sale and those in the brochure to verify what is being offered is accurate.

Suppose the builder is a company registered with the Pakistan Securities and Exchange Commission. In that case, it should be investigated to see if the company is permitted to sell and buy real estate.

What is stamp duty and who pays stamp duty?

Stamp duty is a government-imposed levy or tax that must be paid in full and on time when the property is transferred.

A document that has been stamped is regarded as valid and legal. Unless there is a guarantee to the contrary, the buyer is responsible for paying stamp duty.

Who approves the construction plan?

Building without a building plan approved by the relevant agency is a breach of the related Building Control Authority’s rules and can result in the demolition of the structure.

As a result, it is required for all practical purposes, i.e. before starting the construction process.

In order to read more about real estate sales and purchases in Pakistan, visit Graana blog.