KARACHI: The State Bank of Pakistan (SBP) enhanced the limit of housing finance loans, increasing it to Rs3 million from Rs1 million for borrowings from the microfinance banks.

The central bank also increased the maximum limit of general loans, to Rs350, 000 from Rs150, 000, informed a press release issued.

To avail general loans and housing loans, the annual income eligibility has also been revised, increasing it Rs1.2m and Rs1.5m respectively.

The SBP has also enhanced the limit set for lending against gold collateral to meet borrowers’ immediate domestic or emergency needs.

Under the new conditions, the SBP allows microfinance banks to extend loans against gold collateral for purposes stated as domestic needs or emergency loans.

The bank further added that the aggregate loan exposure of a bank against the security of gold will not exceed 50 per cent of its gross loan portfolio.

“The above relaxations will expire after one year from the date of issuance of these instructions. Thereafter, MFBs will reduce their aggregate loan exposure against the security of gold to 35 per cent within a maximum period of one year,” said the SBP.

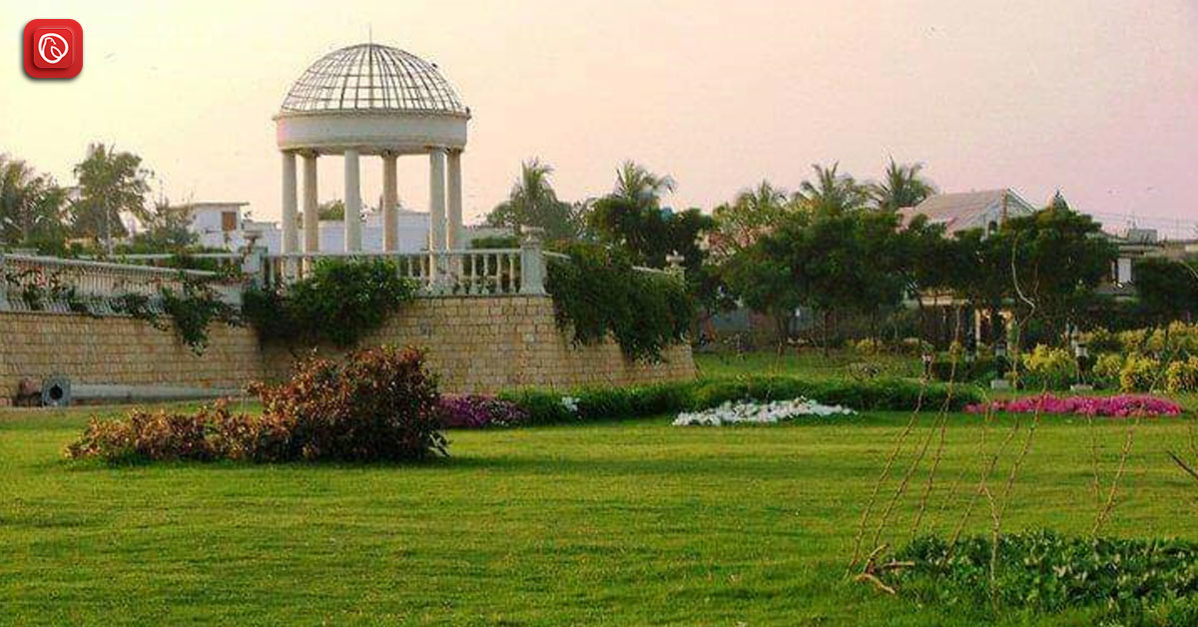

The decision to increase the limit of housing finance loans has been made to promote low-cost housing finance through Microfinancing Banks.

The SBP said that the Microfinancing Banks with a capacity to cater to the higher loan sizes have been permitted to grant increased loans.

“Only those MFBs that are fully compliant with Minimum Capital Requirement (MCR) and Capital Adequacy Ratio (CAR) shall be eligible to undertake microenterprise lending,” stated the SBP.

Under the SBP’s relief package for the microfinance bank, deferment of principal and restructuring of microfinance loans to deal with the adverse impacts of the pandemic has now been expanded.

For news and blogs, visit Graana.com.