If you have never invested or saved money, let us introduce you to an easy way of Mutual funds investment in Pakistan.

Mutual funds have the air of intimidation from their name alone. However, that is not the case. Mutual funds investment in Pakistan offer the following advantages:

- Investments can be made easily and at a low cost by forming a mutual fund. Investments can be started for as little as 5,000 rupees.

- In the case of stocks and bonds that can be purchased with savings, an investor is not burdened with selecting them. The investor is also not responsible for managing or securing the investment.

- In addition, investors don’t have a heavy load of responsibility when choosing stocks and bonds to buy with their savings. Mutual funds investment in Pakistan can provide you with a tax credit, one of the most important benefits.

- Investing in the fund for two years (two years) or more can earn the investor up to 20 percent in credits. Additionally, Voluntary Pension Funds (VPS) offer additional savings of up to 30%.

Types of Mutual Funds Investments in Pakistan

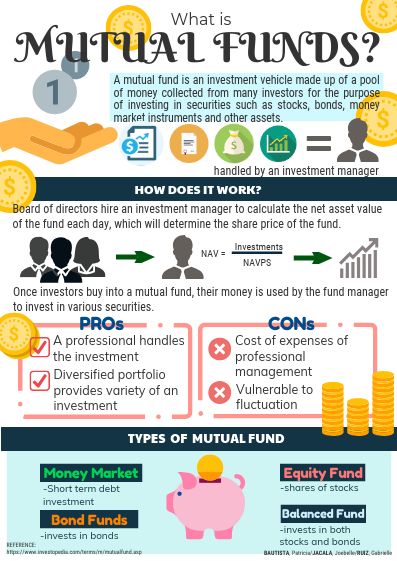

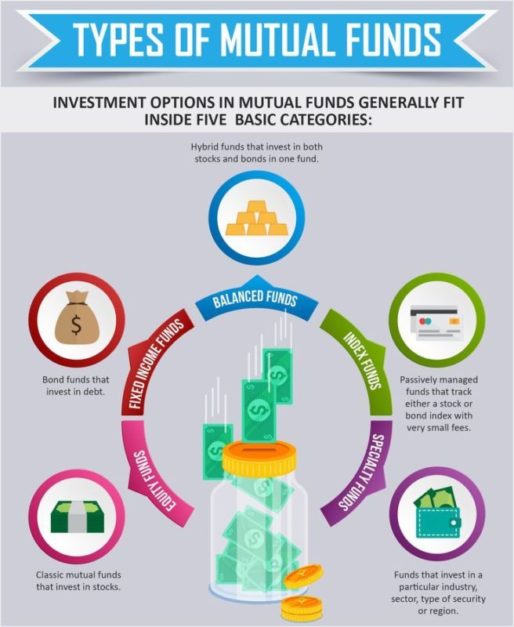

Generally speaking, mutual funds can be divided into two broad categories: a) according to their structure and b) according to their investment objectives.

Based on their structure, mutual funds are either “Open-End Mutual Funds” or “Closed-End Mutual Funds”.

Open-ended funds do not have a fixed pool of money: A fund like this creates new units on demand that can be redeemed when needed. Funds of this type have no size limitations. These units don’t fluctuate in price based on demand but are driven by the underlying assets of funds. The asset management company (AMC) provides daily offer and redemption prices so investors can buy and sell at net asset value (NAV).

In an Initial Public Offering (IPO), closed-end funds are defined as those that issue a fixed number of shares: The Pakistan Stock Exchange (PSX) purchases and sells these shares as soon as they are issued.

There is more open-end mutual fund return in Pakistan. Meaning, it is the best performing mutual fund in Pakistan. Investees own undivided shares of the fund’s portfolio through each unit. When a distribution occurs, each investor shares equally. There is no secondary market for open-end fund units, such as the PSX. Banks and financial companies facilitate mutual funds investment in Pakistan that act as sales agents and/or distributors.

A mutual fund’s assets are held by an independent trustee registered with the SECP. The trustee must ensure that AMC invests the fund’s assets under the approved investment policy and authorized investments of the mutual fund. As a result, all mutual property, including cash, is registered in the name of the trustee.

A guide to analyzing mutual funds investments in Pakistan

Performance

An important aspect to consider is the performance ranking. Every month, quarter, and year, a fund’s performance should be compared with similar funds.

The best funds are those that stay consistently at the top decile. Asset management’s past performance can be a good indication of your savings’ safety.

Ratio analysis

When analyzing a fund’s risk and return, a Ratio Analysis is helpful. To compare your selected fund with other funds available, you can look at ratios such as standard deviation, Sharpe ratio, and Alpha.

A fund’s Alpha must be of interest to investors. The performance of a fund manager is measured by how much it outperformed or underperformed a certain benchmark. Fund manager reports (FMR) are published monthly by asset management companies and include the Alpha for each fund.

Fund management and distribution expenses are included in the Total Expense Ratio. The fund should not have a high expense ratio since it will impact the fund’s returns.

Tenure and experience of Mutual Funds Investment in Pakistan

Your fund manager’s tenure and experience play an important role in choosing a fund. Investing managers have a lot of experience and expertise, which is crucial and should therefore be taken into account when selecting one.

Due to their expertise, fund managers make the final decision regarding fund investment decisions. Their unique investing style will significantly impact the fund’s performance. It is therefore important to research them thoroughly.

Size of the fund

Choosing a mutual fund requires one to consider the fund’s size as well. The concentration risk is greater for funds with limited assets under management (AUM). An exit or redemption by a large investment from a fund with small assets under management may have negative consequences on the fund, as well as on the remaining small investors.

Mutual Funds Investment in Pakistan: Tips to consider

When it comes to investment objectives, risks, and costs, mutual funds investment in Pakistan differ from one another. It is important to know your investment objectives before selecting a mutual fund category for your savings. You determine your financial goals by taking into account factors like your income, age, family commitments, and lifestyle. These factors should be taken into account when choosing an appropriate mutual fund.

How do you plan to use your investment?

Are you in need of regular income; do you want to finance a wedding; buy a house; provide for your children’s education; or do you need them all.

The risk you are willing to accept

Accept the possibility that short-term losses can result from long-term gains?

What does your cash flow need to be?

Your regular cash flow is a necessity to you; or are you interested in growing your assets for your future, or do you require a significant amount of cash to meet a specific need.

Is there a time limit on this?

A short-term time frame of one year or less, a medium-term timeframe of one to five years, a long-term time frame of five to ten years?

You will have a clear picture of what your investment will yield once you determine what your exact requirements are. By doing this, you can choose an accurate strategy for investing in mutual funds. Consider the following investment options to correspond with your time horizon:

- Long Term: When your investment is for a long-term period, such as several years to ten years, and you wish to grow your money, a portion of your money should be transferred to equity mutual funds. You can recover from a market downturn more easily if you have a longer time horizon.

- Medium Term: You would benefit from investing for the medium-term in a balanced and income fund since investing over one to five years may not reimburse you from market declines.

- Short Term: In short-term investments, there is very little recovery time if you lose money. The time it takes to recover from losses is very short if you invest for a year or less. When picking a mutual fund, make sure there are no withdrawal restrictions. You should also choose investments with low risks.

Conclusion

Salary-earning individuals have more advantage of mutual funds investment in Pakistan, with the best returns. The decision to choose a mutual fund becomes easier for salaried individuals when they know their requirements, needs, saving targets, and goals

Choose the fund you want, and then relax as your savings grow significantly, helping you reach your long-term goals.