Real estate is one of the most lucrative sectors, in terms of return on investment (ROI), in Pakistan. Prices for residential properties in Pakistan, for example, have risen from PKR 5,218 per square foot to PKR 8,316 per square foot (a rise of 59.37 per cent) in the last five years. This makes real estate one of the safest sectors to invest in as prices are bound to rise. However, there are certain risks of investing in real estate that need due diligence by the investors, in order to not only protect their investment but also maximise their profits.

Graana.com, Pakistan’s smartest online real estate portal, takes a comprehensive look at these risks in Pakistan.

Why Invest in Real Estate

At a time when numerous other markets are registering growth at a neck break pace, the question arises: why should you invest in real estate at all? The following are some of the reasons you should consider why:

- Investing in real estate is one of the safest bets you can make. Even in COVID-19 lockdowns, as a result of tax relaxations provided by the government, the sector registered growth.

- Unlike other sectors, real estate can appreciate its own value. This is done by providing better amenities to the tenants. If a builder competes and provides better facilities than what others are offering, they can ask for a higher price than the current market price.

- It goes without saying that good investors never place all eggs in one basket. Since real estate rarely depreciates, it is a good option to diversify one’s portfolio.

- Numerous other industries are linked to real estate, therefore governments often incentivize taxes for the sector in order to achieve growth.

- Given that your records are clean and your planned investment in real estate is sound, banks are willing to invest in your projects.

- Real estate is tangible and one of the easiest assets that you can pass down to your generations.

- It might be the case that you decide not to invest in real estate as your primary source of income but, given its advantages, you can still invest as a way of acquiring a passive income.

Property Location

When investing in a property, the location should always be the first priority. After all, a house can’t be moved to a more desirable neighbourhood, and a retail establishment can’t be moved out of an abandoned strip mall.

The criteria that determine your capacity to generate profit are ultimately determined by your location — including the demand for rental properties, the types of properties that are in the highest demand, the tenant pool, rental rates, and the possibility for appreciation.

The optimum location, in general, is the one that will yield the maximum return on investment (ROI). However, it is advised to conduct a study beforehand to identify the greatest sites that give the best return.

Supply Risk

As real estate is immovable, supply and demand have a greater impact; consumers move across markets in response to price fluctuations caused by these forces.

A major increase in supply, like in any other market, can put current property values at danger. This can happen directly, where the increase in supply causes the value to stay more or less constant, or indirectly, where new units need to be absorbed by the market i.e. stay vacant for some time before value growth can resume.

Rental Risks

Many people invest in real estate because it provides a steady income. However, there is always a risk in that income stream because the landlord is vulnerable to tenant credit risk, which could result in cash flow gaps due to unplanned downtime or vacancy. Rental risk is indeed a big part of the real estate hazards that might affect your revenue.

Negative Cash Flow

The money left over after all expenses, taxes, insurance, and mortgage payments on a real estate investment is referred to as cash flows. When the money coming in is less than the money going out, you have a negative cash flow, which means you’re losing money.

Negative cash flows can be caused by a variety of factors, including:

- The property stays vacant for long periods of time

- Underestimating maintenance

- Taking out loans for construction with high-interest rates

- Renting the property at lower rates

Doing your research before buying is the best method to decrease the danger of a negative cash flow. Take the time to calculate your expected income and expenses precisely (and realistically), and do your homework to ensure the property is in a desirable location.

Lack of Liquidity

If you own stocks or bonds, the process of selling them when you need money or if you just want to cash out is simple. However, that isn’t always the case when it comes to real estate investing. If you need to sell your home quickly, you may have to sell below market value or at a loss due to a lack of liquidity.

While there isn’t much you can do to mitigate this risk, there are ways to access the equity in your home if you need money. For example, you can take out a home equity loan (for residential rental properties), a cash-out refinance, or a commercial equity loan or equity line of credit (for commercial properties).

Structural Integrity of the Property

Underestimating the expenses of repairs and upkeep is a surefire way to lose money on an investment. For commercial buildings, structural repairs or treatment of mould or asbestos might easily cost tens of thousands of rupees.

Fortunately, you may reduce this danger by thoroughly inspecting the property before purchasing it. Hire a qualified and trustworthy property inspector, contractor, mould inspector, and pest control specialist to “look under the hood” and find any hidden problems. If a fault is detected, determine how much it will cost to correct it, and either factor it into your agreement or walk away if it prevents you from generating a decent profit.

Property Taxes

Real estate investors are subject to several taxes. Capital gains tax, income tax, and property tax are a few examples.

Because of the various taxes, there is a chance that at least one of them will fluctuate during the time of investment. Property taxes, for example, may fluctuate throughout the investment’s life, resulting in unfavourable results. Investors should be aware of changes in the tax legislation and plan accordingly.

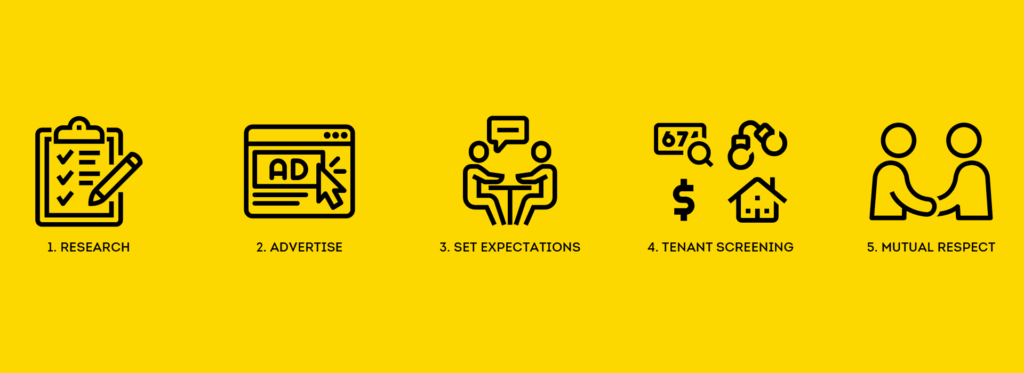

Finding Suitable Tenants

Ideally, you would want to keep your investment properties occupied to reduce vacancy risk. However, this can lead to a new risk: problematic tenants. A lousy tenant can be more expensive (and more of a headache) than having no tenant at all. Tenants with difficulties include individuals who:

- Pay late or not at all (which could result in a lengthy/expensive eviction process)

- Damage the property

- Delay in informing about maintenance issues

While it is difficult to completely prevent the possibility of a problematic renter, you can minimise the risk by executing a thorough tenant screening process. Make sure every applicant has a credit check and a criminal history check. Check with each applicant’s former landlords for red flags such as late payments, property damage, and evictions.

In a Nutshell

Doing your due diligence and doing a thorough real estate market and rental property study will help you reduce your risks. Hire professionals to assess the property, screen possible tenants, and educate yourself on the real estate market.

Keep in mind that there are numerous ways to invest in real estate without having to own, finance, or operate actual properties. Real estate investment trusts (REITs), real estate stocks, real estate crowdfunding, and real estate partnerships are some of the options available.

Consider acquiring a new skill or obtaining a new licence as an investment in yourself. Many real estate investors, for example, become licensed real estate agents or brokers to take advantage of benefits, such as access to the multiple listing service (MLS), networking, and commissions made on sales and rents.

Risks are always present in the market and investors must take them into consideration before making any financial decisions. One framework that can help investors in calculating these risks is the OADD (Ownership, Approval, Demand, and Delivery) process. Investors can check whether ownership of the property is not challenged in any court of law and has the necessary approvals. Lastly, investors can check the demand of the project and how the owners plan to deliver the claimed ROI.

To read more on real estate investment, visit Graana blog.